Business Insurance in and around Lincoln

Get your Lincoln business covered, right here!

Helping insure small businesses since 1935

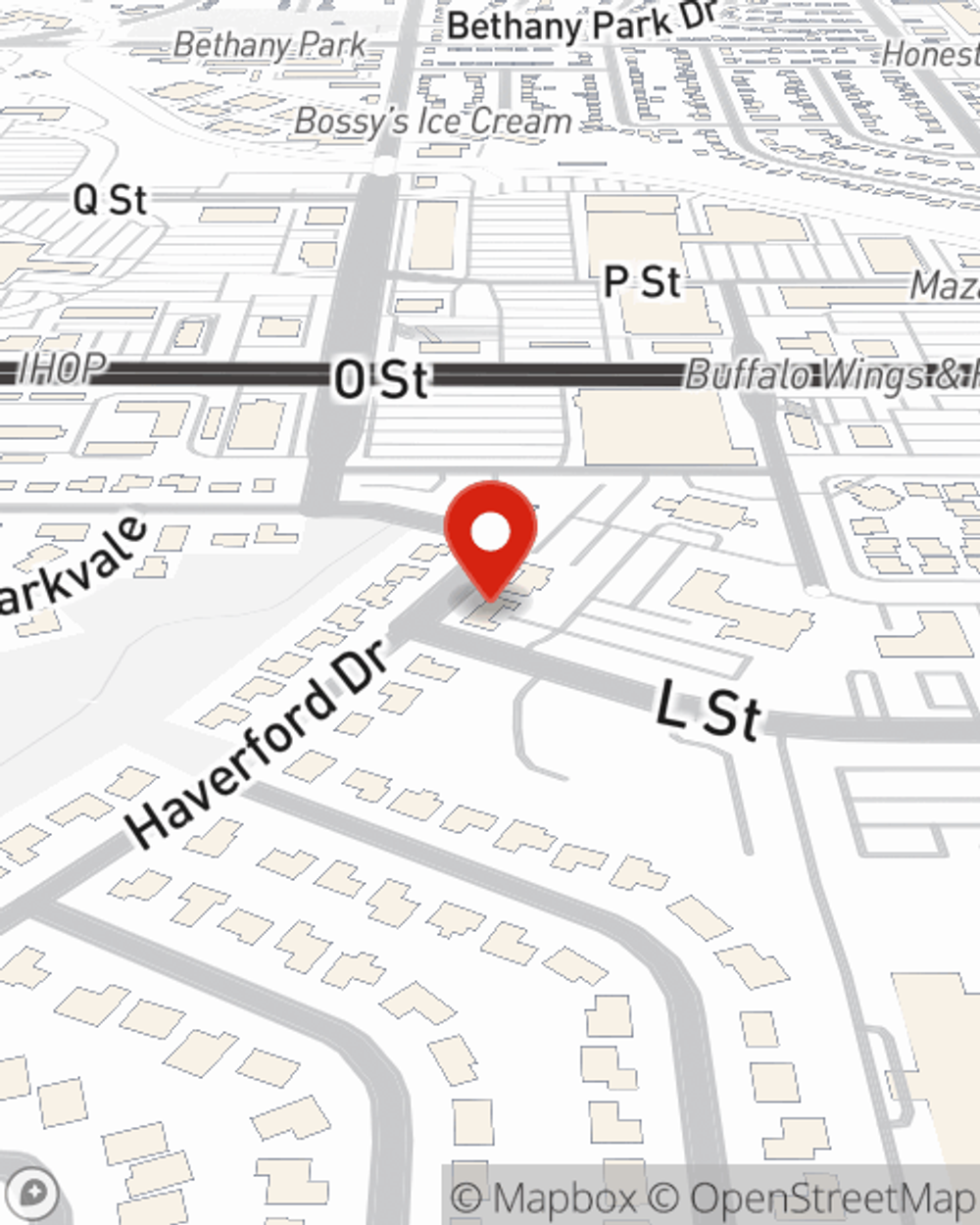

- Lincoln, NE

Cost Effective Insurance For Your Business.

You may be feeling like there's so much to think about with running your small business and that you have to handle it all by yourself. State Farm agent Genny Noerrlinger, a fellow business owner, recognizes the responsibility on your shoulders and is here to help you get started on a policy that's right for your needs.

Get your Lincoln business covered, right here!

Helping insure small businesses since 1935

Protect Your Business With State Farm

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is shut down. It not only protects your pay, but also helps with regular payroll expenses. You can also include liability, which is key coverage protecting your business in the event of a claim or judgment against you by a customer.

Reach out to the wonderful team at agent Genny Noerrlinger's office to discover the options that may be right for you and your small business.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Genny Noerrlinger

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.